Airbnb (ABNB) Financial Articles

Airbnb, Inc., together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily... Read More

Report Summary

- Only a non-material part of business's revenue comes from Haram.

- Interest is used but is not relied on to run the company.

- It is questionable whether the company’s net impact is positive or negative on at least one of the following: environment, society or governance.

Business Commentary

Airbnb maintains and hosts a marketplace, accessible to consumers on its website or via a app.

Through the Airbnb service, users can arrange lodging, primarily homestays, and tourism experiences or list their properties for rental. Airbnb does not own any of the listed properties; instead, it profits by receiving commission from each booking.

The company also offers a service called Airbnb Experiences wherein renters can take part in activities like cooking classes, tours, and adventures.

The Halal Investors see nothing inherently wrong with either the bookings done through the Airbnb site or the commissions Airbnb collects from these bookings.

There are activities booked through Airbnb Experiences that involve wine and alcohol tasting which are haram to profit from.

It's impossible to say how much of Airbnb bookings involve alcohol but its safe to say they are a minority of listed experiences which itself represents a minority share of overall Airbnb revenue.

Financial Commentary

Airbnb's relationship with interest

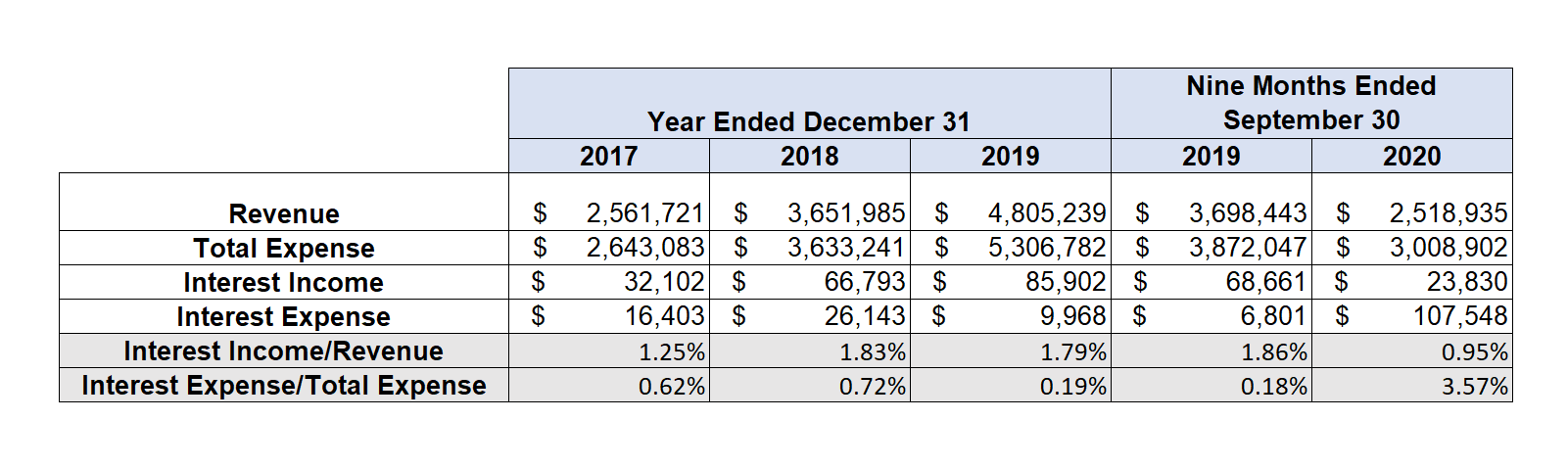

With regards to Airbnb's interest income, it has been rather steady over the years for Airbnb at between 1 and 2% of Total Revenue. As for Interest Expense, it was virtually zero up until 2020 when it had to take out debt to deal with the pandemic and interest expense jumped to around 3.5% of total expense. The Halal Investors does not think Airbnb’s interest expense implies a reliance on interest. We are further encouraged by Airbnb’s low use of interest pre-pandemic and expect it to return to these low levels after the pandemic.

ESG Commentary

Airbnb has had a positive impact in the lives of millions of hosts that were able to monetize their properties in a way that was previously impossible. On the other hand, Airbnb has allowed travelers to experience different parts of the world in a unique way and hopefully enhanced understanding of different cultures in the process. Allah SWT says in the generous Quran:

“O people, indeed We have created you from male and female and made you peoples and tribes so that you may get to know one another. Indeed, the most noble among you in the sight of Allah are the most pious. Indeed, Allah is All-Knowing and Acquainted.”

-The Holy Quran, Chapter (49) Surat Al-Hujurat

Halal Investors think Airbnb can potentially be a tool for people to do this getting to know one another that Allah SWT encourages.

Scandals

As can be expected when you have a business that allows strangers to open their homes to other strangers, there have been some scandals associated with Airbnb. For example, in October of 2019 five people were shot and killed at a “party house” in Orinda, California that had been rented via Airbnb. As part of its response, Airbnb announced a global ban on all parties and events at Airbnb listings, including a cap on occupancy at 16. Another Airbnb scandal included houses that didn’t really exist being listed for rental on Airbnb's website. Airbnb responded by announcing: “it will begin the process of verifying all 7 million listings on its platform. By December 15, 2020, each home and host will be verified by Airbnb for “accuracy of the listing (including accuracy of photos, addresses, and listing details) and quality standards (including cleanliness, safety, and basic home amenities),” according to a statement released to the press.

Delisting of West Bank settlements

In 2018, Airbnb announced it would remove 200 listings in Israeli settlements in the West Bank from its platform; a step in the right direction.

In response, several Israeli lawyers sued the company for a combined $840,000 for its attempted withdrawal from the illegal settlements. Faced with these costs and substantial legal fees, Airbnb backtracked on its decision and the 200 listings remained on its website.

To their credit, Airbnb announced it would not take any profits from listings in the settlements; instead, the money would go to “organisations dedicated to humanitarian aid that serve people in different parts of the world.”

These facts and the overall impression that Airbnb was genuinely trying to do the right thing is what drove our initial rating of “Comfortable”.

Another perspective on this matter is the following: The illegal settlers correctly calculated that inorder to coerce Airbnb to act in the way they want and normalize their thievery, they needed to make Airbnb pay a heavy price for attempting to do the right thing.

Their plan worked.

Rather than acquiesce, the appropriate response is for the good guys (the internationally recognized rightful owners of the land and their supporters), to make Airbnb pay an even greater price for not doing the right thing.

One could argue that not investing or dealing with the company until it completely dissociates with the illegal settlers is a step in this direction.

Considering we think there are reasonable arguments on both sides of this discussion, one focused on Airbnb’s clear willingness to do the right thing when left uncoerced and the other focused on countering the settlers’ attempts to inflict a heavy price on Airbnb if it chooses to do the right thing, we are giving Airbnb a “Questionable” ESG rating.

Agree or disagree with our halal report cards? Share your feedback.