The best time to start investing...

Highlights

“The best time to plant a tree was 20 years ago. The second best time is now." Starting to invest earlier in life enables you to maximize your investment growth.

As the Chinese proverb goes “The best time to plant a tree was 20 years ago. The second best time is now." This timeless wisdom is especially true when you consider the compounding effect of time on investments. Unfortunately, lack of financial literacy has led to Americans having inadequate savings and extremely high levels of credit card and student loan debt. Although the barriers to entry into investing has decreased immensely with the advent of modern technologies, many people like myself have started investing later than we should have due to analysis paralysis on where to start and how to optimize investing the right amount and choosing the right places to invest.

In my personal experience, having been born and raised in the US, I’m appalled at the insufficient job the public education system does in teaching financial literacy. With the increasing wealth gap and an ever-increasing consumerist society we live in, it often seems investing and financial literacy is limited to the financial elite. I didn’t begin my investment journey until after graduating, getting a job, getting married, and having my first child. Not because I didn’t know the importance of investing and saving, but simply because I didn’t know where to start.

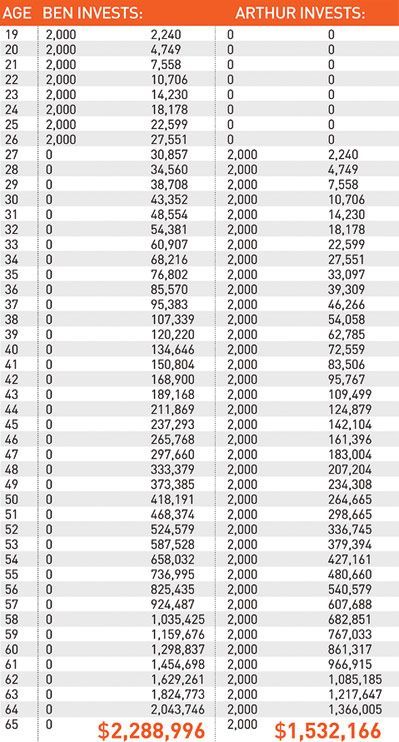

One of the things that attributed most to getting my investment journey started was visually seeing the difference it makes to start early. Consider two investors, one who starts at the age of 19, and the other starts at the age of 27. Both invest $2000/year ($166/month or $40/week), but the younger investor invests for only 8 years and stops investing after the age of 26. The older investor continues to invest for 38 years consistently. Surprisingly the younger investor ends up significantly ahead of the older investor.

start investing early

This is the power of compounding growth over time and why it’s so important to start early. Now just imagine what impact generational wealth has on the outcome of racial inequality in the United States!

So my number one recommendation as a practicing Muslim seeking to do good and do well with my wealth & finances and helping others do the same is to start early. Don’t allow analysis paralysis to prevent you from starting.

Sa’d reported: The Prophet, peace and blessings be upon him, visited me while I was ill in Mecca. I said, “I have some wealth. May I donate all of it?” The Prophet said, “No.” I said, “Half of it?” The Prophet said, “No.” I said, “A third of it?” The Prophet said, “Yes a third, but this is still too much. That you leave your inheritors wealthy is better than leaving them dependent, begging for what people have. Whatever you spend on them is charity for you, even the morsel you feed to your wife.” Ṣaḥīḥ al-Bukhārī 5039

Here are 3 things to consider to start your investment journey if you haven't already:

Budget and give every dollar a job. What doesn’t get delegated gets easily spent. Ideally you should be working your way towards saving 20% of your paycheck (See The 50/30/20 Rule of Thumb for Budgeting ) and ideally automating investing (see below).

Eliminate debt as quickly as possible and avoid it at all costs. Pay off your student loans as quickly as possible. Don't accrue credit card debt. No one becomes a millionaire with credit card reward programs. Credit cards have their uses, but know that they are designed by the banking industry to get you into debt.

Automate your investments. For the VAST majority of us, picking individual stocks on Robinhood is a guaranteed way to get duped into the fads and hypes of the market. Robinhood makes its money by getting you to buy and sell (volume of transactions) and you also lose out by paying more taxes if you sell within 1 year (short term vs long term capital gains). Instead, invest in halal mutual funds or index funds. Better yet, build your own using M1 Finance and auto-deposit every week or month to benefit from Dollar Cost Averaging , and revisit your portfolio once per quarter. Using M1 Finance also enables you to filter out companies that don't align with your values.

In future insights and posts we’ll do a deep dive into specific options beginning investors have who are conscious about ethical and halal investing. If you’re already investing, consider leaving a comment with your advice for new investors so others can benefit from your experience.

Agree or disagree ? Share your feedback.