Upwork: Is it time to sell?

Highlights

- Upwork stock has doubled in the past 2 month

- Solid Q3 results caused Upwork's share price to breakout to ~$30 per share

- I will keep the composition of Upwork in my portfolio as is in light of the company's prospects

On September 21st, 2020 I recommended Upwork back when it was trading at around $15 per share. Since then it has doubled in price and is now trading at $30.84 just two months later. Naturally, having doubled my investment in a couple of months, the question suggesting itself is: should I pack it in and look for greener pastures elsewhere? or is there still a lot of meat left on the Upwork bone?

Upwork's Fundamentals

The most recent price breakout to $30 a share came on the heels of Upwork’s very strong third-quarter results. Sales grew 24% year over year in the quarter, and gross profit margins on those revenues improved by 2 percentage points to 73% . For 2021, the company is predicting 20% revenue growth -- which would work out to roughly $437 million -- well ahead of the $407 million or so that Wall Street was projecting. In the last six months, the platform’s number of freelancers and corporate registrants has increased by 50%. Twelve percent of the U.S. workforce started freelancing amid the pandemic.

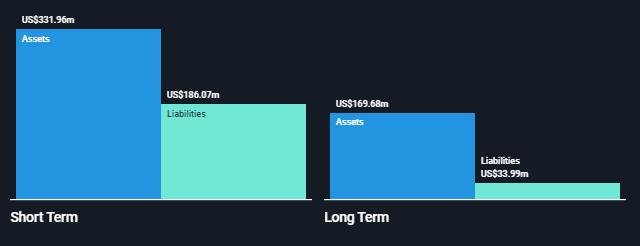

Nearly three quarters of hiring managers are continuing or increasing their usage of independent professionals. As far as their financial position, Upwork has around twice as many current assets as current liabilities and should have enough runway for the next 3 years (expected time to profitability).

Upwork Assets and Liabilities

I’m fully aware that Upwork’s numbers have benefited from the pandemic and that this pandemic will not last forever. However, I do believe that the behavior changes related to remote work are here to stay and the benefits Upwork has gained from these behavior changes will outlast the current pandemic. In summary, Upwork is the largest marketplace in the world for a service that I think will continue to gain in popularity for years to come with solid growth numbers and a robust balance sheet.

Upwork's Valuation

To get an idea of how reasonable Upwork's current valuation is at ~$30 per share, it's useful to compare it with the other big player in the space, Fiverr.

Fiverr Market cap ~ 6.09B 2020 Revenue ~$187 million Profitability forecast for the end of 2021 Price to sales ratio of ~32 Upwork Market cap ~ 3.76B 2020 Revenue ~$365 million Profitability forecast for the end of 2023 Price to sales ratio of ~11

In light of this comparison, I think Upwork is the better value when compared to Fiverr.

I think there is a high likelihood that Upwork reaches the $50-$60 per share mark 2-3 years from now which would mean I’ve doubled my investment in 2-3 years and I’ve exceeded my 30% target average annual rate of return. Accordingly, I’m keeping my Upwork stock at its current level of 6% of my portfolio.

Disclaimer: The author of this post holds a long position in Upwork common stock.

Agree or disagree ? Share your feedback.